Jacob, an unassuming college student, has an impressive investment portfolio in place of what is typically sizable debt. Following his father’s strict outlook on education and a self-interest in money, Jacob started investing early to be financially independent sooner, and has now accumulated almost $35K in his early 20s.

STEP 1: Save First

How did you find money to save despite being a student?

I took advantage of living with my parents. At home my mom would pack me and my younger brother’s lunch every day. I also used public transportation to save on costs.

Also, I had been observing the way my dad managed money. He would discuss weekend spending with us and why saving matters. So, I naturally had been putting all my earnings and pocket money into a savings account since my first job in grade 11. I was always working part-time, summer jobs, etc. It took me roughly 3 years to save $15K.

My friends asked me why I don’t just buy a car with my money. To me, a car right now is more of a liability than an asset. I’d have to pay bills, insurance, and maintain the car. I’d rather wait until my money earns more money to be financially independent first. I will buy a car and go to trips with my passive income not with my hard-earned money.

STEP 2: Set Up an Investing Strategy

When did you start learning about investing?

I studying economics, so I have more of the basics than others do. I’m a cautious person by nature, so I want to follow the strategies of experienced people. There are lots of simple books and youTube videos. Although I don’t have all the details, the overall lessons from wise investors are pretty simple to understand:

- Don’t try to beat the market

- Focus on reducing the cost of investing (fees)

- Start early to benefit from compounding

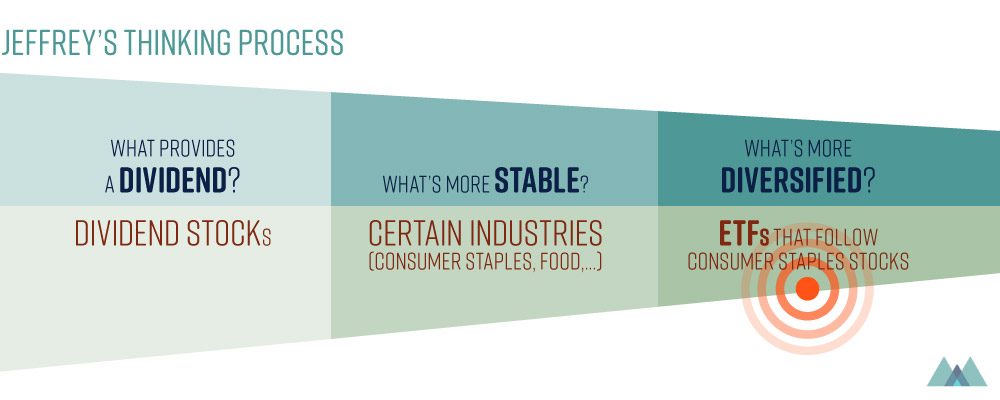

I discovered that because how young I’ve started, I could invest mainly in stocks (equities). But I wanted to invest in less volatile industries, and ones that generate passive income through dividends. I had no interest in super risky stocks.

What kind of investment products did you consider?

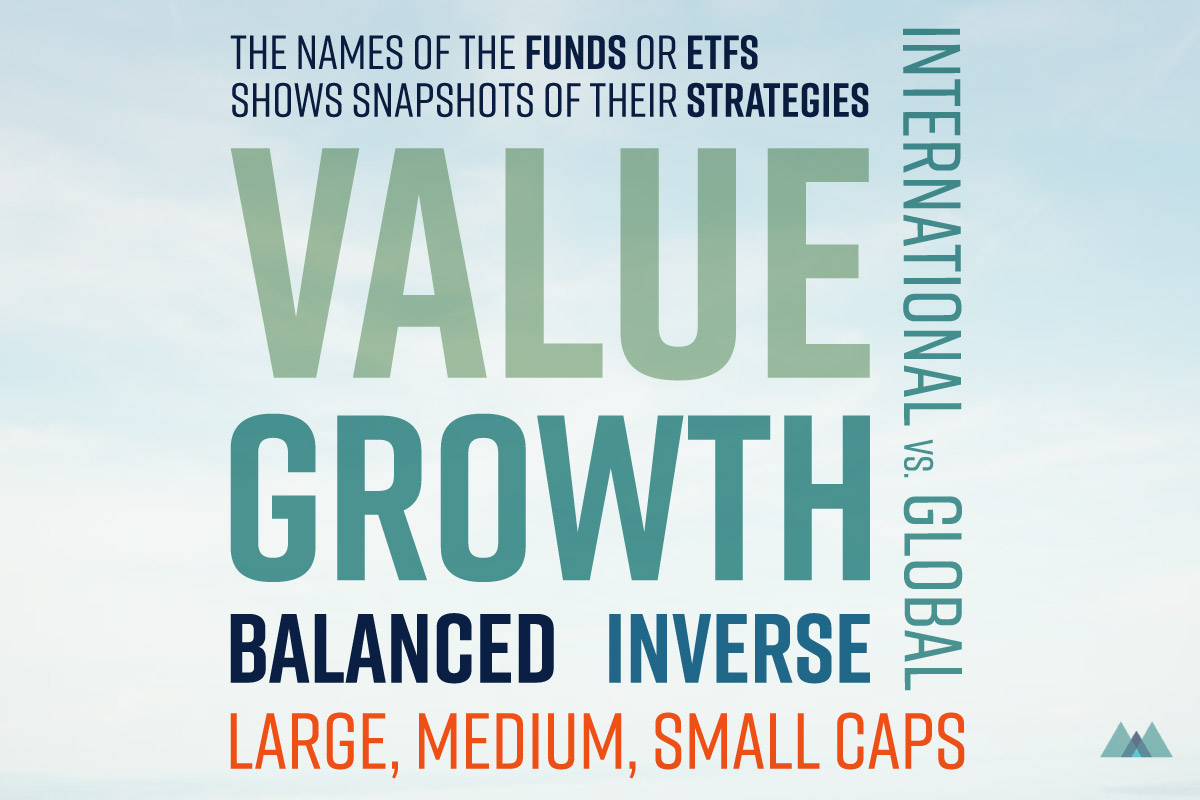

I juggled among the common investment options at first. GICs are guaranteed but interest rates are so low that it can’t even beat a 2% inflation rate. Lots of people also invest through mutual funds, but they charge management fees of roughly 2%. Most experts says the cost of investment should be less than 1%. So I decided to focus on dividend-paying ETFs in stable industries.

STEP 3: Open Up a Discount Brokerage Account

Where did you go to set up your investments?

It’s pretty simple. I opened up a discount brokerage account at my bank. I put in most of my savings so I wouldn’t have to pay annual account fees. Since trading fees are roughly $10 per transaction, I traded in lump sums (of more than $2K) to minimize transaction costs. I used the brokerage’s online platform and MorningStar to keep up with updated information.

The first assets I bought were actually stocks in consumer staples. But after going through multiple ups and downs I decided to invest in ETFs. I personally found stocks to be too tiring and requiring a lot of attention.

Sherpa Tips: Discount brokerages offer various fee options. Compare account, trading, and sales fees before choosing one. You don’t always need a lump sump to start. Don’t forget to ask about student discount too.

STEP 4: Focus on Sector ETFs

How did you choose and manage the ETFs?

I “buy and hold” dividend-paying ETFs in stable industries, such as utilities and consumer staples (food, beverages, household items), instead of highly volatile industries like technology or healthcare. I also bought a dividend-paying Gold ETF. Gold tends to go up when the economy is uncertain.

All of my investments are under TFSA, so I don’t have to worry about dealing with tax matters now. I simply max out my TFSA and let my investment grow within it every year. When I get a full time job, I plan on starting a RRSP.

Sherpa Tips: A lot of ETFs target a particular sector. An ETF that is focused on Consumer Staples will only buy companies that operate in the Consumer Staples industry. These are firms like Kraft Heinz and Procter & Gamble. Other Common sectors are: Financials, Technology, Energy, Industrials, and Raw Materials.