May and Zoe are in their mid-20’s, they have been friends for a long time and both have passion for fashion design. After researching market potential and manufacturing process overseas, they decided to set a business partnership to create a new baby clothing brand in Canada.

Step 1: Organizing the Partnership Agreement

After all the fun idea sharing, what was the first step towards you getting really serious?

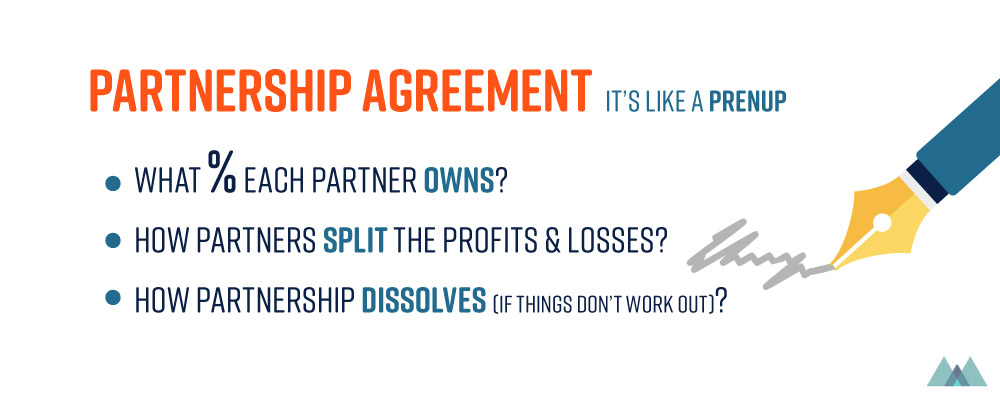

Setting up a partnership business was like getting married but for this business. We had fun talking about the vision, design, and market. Then, we had to work on the General Partnership Agreement. By filling out this online partnership agreement form, our idea became much more tangible.

The tricky decision we had to make is how we divide up our ownership. We used this Co-Founder Equity Calculator to come up with numbers in advance. Trust me. Business partnerships break up more often than marriages, and we don’t want to damage our friendship in the future.

Are there any benefits for registering your business as a corporation though?

Actually, we could have chosen a corporation instead of a partnership. We choose a partnership for now since it has a lower start-up cost and less formalities. If we run as a corporation, we have limited liabilities. This means if we, as a corporation, can’t pay our debts, creditors cannot go after each of us for our personal assets. We thought about it however we’ve agreed we don’t see a need right now. Anyways, we can convert our partnership into a corporation at anytime later. It can be quickly done online.

My accountant also told me that owners can still be liable to a corporation’s debt because lenders can include personal liability terms in the lending contract. For example, our $5,000 overdraft protection plan for the business bank account has a condition that says that we are personally responsible for the debt.

STEP 2: Business Partnership Registration

What did you need to know to register your business?

It’s probably the same as other businesses. We got the Business Number (BN) when registering our business. Then, we could open tax accounts: GST/HST account, Payroll account, Import/Export account and WSIB.

What we care about is the Import/Export account. Because we decided to find a manufacturer in China, our import account can make it easy when goods reach the border and it’s time to pay the right duty amount.

It is not mandatory to register a HST/GST Account for a business until the business generates more than $30,000 in annual taxable sales (although it can be a good idea if we are paying lots of GST/HST on business expenses). Also, payroll account registration is only required if you have or are planning to have employees. Anyways, they all are connected with the BN. It’s straightforward.

STEP 3: Handling Money Together

How two partners manage money fairly together?

We opened a joint business bank account that both of us can access freely and track transactions.

- Startup cost: we used this online template to come up with our own spreadsheet to share. Futurpreneur has a great template too.

- Ongoing fixed costs such as web hosting, subscriptions to software are all paid from a business credit card.

- Variable costs such as food and entertainment, travel, conferences, and marketing are covered within a monthly budget

The key is finding a good online banking system to keep each other informed and so we can make quick decisions when necessary.

Tell us a bit more about the bank account. Do partners need to get permission from each other to write a big cheque?

Banks now have a variety of business account services. We just need to figure out what we need. We prepared questions, such as options for foreign currency account, the maximum number of transactions every month, overdraft fees bank will charge during busy months.

We set a spending limit of a maximum withdrawal of CAD $1,000 per transaction. If we exceed this limit, the approval of both of us is required for the transaction to go through. We also receive email / mobile notifications when either of us withdraw money.