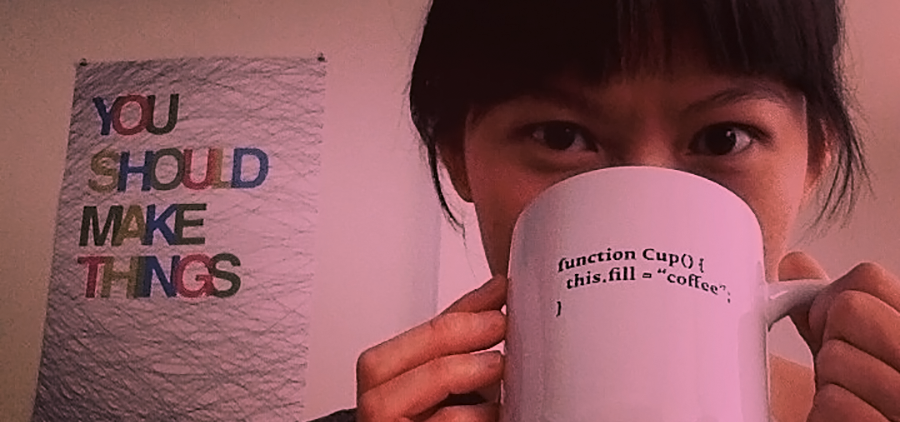

Pearl Chen is a successful technologist and educator with over 10 years of experience in building interactive experiences. She has worked with Intel, Google, TELUS, Ladies Learning Code, and CFC Media Lab. However, her financial situation was quite humble at the beginning. Check out how she has built her career and financial freedom below. Pearl also shares her creative plan to fund her European trip by providing a home cooking service. It sounds not only money-saving but also extra fun.

Past mistakes: credit card debt

Julie: We can perhaps go back to the money history first. Is there anything you would do differently if you could go back 10 years ago?

Pearl: I wish I would have grown up with an allowance. My parents were all about saving every penny and being frugal, which is not fun. So once I got access to a credit card, I didn’t know the consequences. I wish I would have learned the balance between being frugal and having fun earlier. Then, I wouldn’t have had so much credit card debt in university.

Julie: But you paid off of your debts quite fast. How did you make it happen?

Pearl: The first thing was just acknowledging how much debt I had. I went and put everything I owed into a spreadsheet so I had the full picture. Then coming up with a realistic payback plan. Nothing ground-breaking: Pay off the cards with the highest interest first, then just being consistent with making payments.

Julie: A textbook solution. Did anyone advise you to do so?

Pearl: No. But I might have read articles about it. I was actually pretty embarrassed by it so I never told anyone.

Julie: Anyways you took the immediate action to resolve the issue, which is amazing. “Have you ever felt like you miss out on having fun due to the debt payments?”

Pearl: I do remember having to cut back on non-essential spending at first. e.g. clothes, eating out. But then I also realized that I could spend less money, or just make more money. I like the latter option better 🙂

Julie: Yeah. Everyone does 🙂

Pinkfolio:

- You may not need an expert’s calculation to improve your debt situation. The only way to solve it is taking the action NOW like Pearl did.

- Consider refinancing your high interest debt with lower-interest loans or P2P Lending (lending money through online platforms that match lenders directly with borrowers) since it could reduce your monthly cost and help you to repay your debt even faster.

How Pearl makes more money

Julie: So you worked full-time before, then became a successful business owner. I wonder, you weren’t concerned too much about income fluctuations?

Pearl: Yes, when I first started freelancing, the work was inconsistent. I remember not having any clients for 3-4 months and feeling stressed about it. But then once I hit my stride, I find that I turn away more work than take.

Julie: That sounds awesome!

Pearl: I’ve always increased my “salary” or net income every year with some exceptions. Freelancing has more flexibility (sometimes), pays better (sometimes), and the work has more variety. Doing a salaried, FT job seemed kind of boring.

Julie: Hm,, but getting good clients is a big challenge. Any secret you could share with other hard working freelancers?

Pearl: Do good work and network, network, network. The first year I started freelancing, I worked for a creative temp agency and they helped find clients for me while I built up my portfolio.

Julie Hyunjoo Lee: Of course. And I love your website.

Pinkfolio:

- Nothing beats human interaction when it comes to sales. Sell yourself and prove your value to grow your own business

- Keep tracking the growth of your business and your income to make smart decisions on your freelance business.

How Pearl plans to fund her fun trip

Julie: Perhaps we could move on to the fun part. I admire your plan to travel Europe and work on your hardware startup. Would you share your unique plan to fund your travel and startup?

Pearl: I like to cook (@pearlmakesfood). And some people are bad at cooking or too busy, so I thought I would barter my cooking for places to stay to keep my budget manageable. This isn’t all that far-fetched in my opinion. Conferences would pay for my flight and hotel in exchange for me to do a presentation. So why not providing cooking services instead of presentations? It’s just a different way of looking at what people need and filling in a gap in a way that’s an advantage for me.

Julie: That’s what exactly what people know but don’t do. I think that’s how a business ultimately works. You said you’ve tried this home cooking service to your friends to check if it works.

Pearl: It worked out really well for my friend who recently had a baby. The couple was so occupied by the newborn and work while still wanting to eat healthy. I prepped healthy freezer meals to make their life easier.

Now I plan on creating a web page outlining what I’m doing, what kinds of hosts I’m looking for, and what the exchange is: healthy home cooking for accommodations. Then I’m going to send it out to my immediate network so they can pass it on to friends.

Pinkfolio:

- Always seek others’ needs and think creatively about how you can help. Don’t let your ideas fade out. Give them a try with your contacts.

- There are so many options to fund your travels. Rationalize your trip with own projects, initiatives, and share what’s going on with others

Future plans: get rich with NO risk?

Julie: Finally, the last question. Is there anything you’d like to learn more about money for your long-term security?

Pearl: So what I’ve realized about “retirement” is that you just have to start now and be consistent with squirrelling away money that you don’t ever touch. I would love to have more information around how to make piles of money turn into bigger piles of money but there’s a trade-off between risks and security.

For me, I did really well with real estate but even that’s not always “safe” (She bought a condo in Toronto many years and sold when it was high). So if you come across a get rich scheme with NO risk, let me know 🙂

Pearl: But related to real estate, I could have made MORE money but there were some missteps along the way. I could have made almost the same amount of equity/savings by just being consistent with squirreling money away, spending less, and it would have involved less paperwork, less real estate agents, and less lawyers. So building wealth is never a simple 1 plan fits all. It depends on the situation.

Julie: That’s so true. Keep learning and acting proactively really matters to growing money. Once you know the basics, personal finance is not really rocket science anyways. You can perhaps take our investment course and fully assess your risk tolerance ☺

Pinkfolio:

- There is no way around NOT taking any risk when it comes to growing money. Risk is not the matter of taking or not taking, it’s more about how much you decide to take. In fact, Pearl is taking a high risk by investing her resources to her own startup.

- Financial trends change fast. You always want to stay as a learner as well as action taker. Join Pinkfolio to learn more.

And,, more of her foodie pictures. I knew you wanted more. Visit @pearlmakesfood and spread words to your European contacts~

It is important to find a balance between having fun earlier and saving for future.

I love the approach of knowing my goal and setting a plan FIRST, then spending whatever is left, without guilt and enjoy myself!

If there’s a way to get return with no risk, everybody would do so. Returns are paid to compensate the risks investors take; if there’s no risk, there’s no compensation.