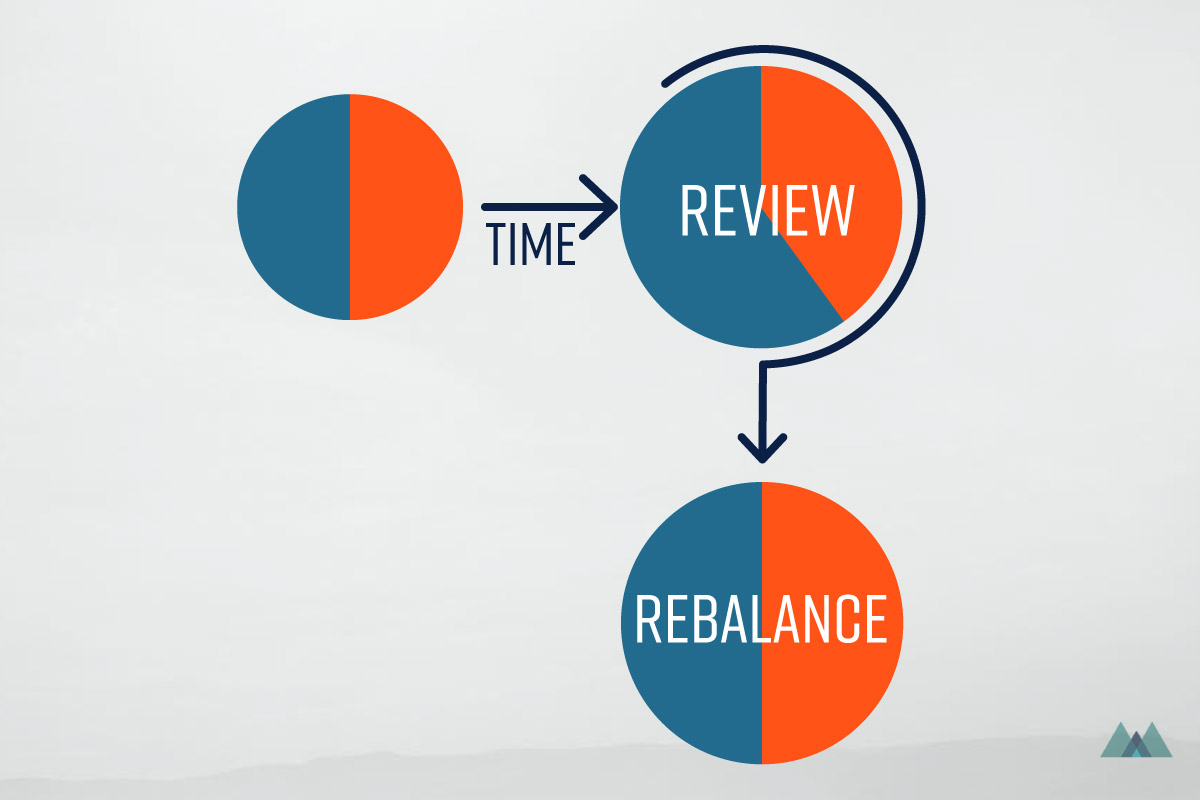

If you are following a passive investing strategy, you don’t need to follow market fluctuations every day. Observing market fluctuations can be stressful and distract you from your original strategy. Unless something new happens in your life, or you suddenly receive a big chunk of money, all you need to do is check on your investment a few times a year.

Review

Review your portfolio to check whether your investments are performing reasonably. Most banks or brokerages have websites presenting how your investment is performing. If you have investments in multiple locations, setting up a Morningstar account to put all portfolios together can help. There are a few things to ask yourself.

- Just be average: Check how your portfolio performs compared to the benchmark market return.

Indexes such as S&P 500 (US) or S&P TSX (Canadian) shows the market average, and it’s all good if your fund is matching the average. - Risk changes: The world is always changing. There can be financial and political events happen that make certain investments more or less risky.

- Your life events: If something new is happening in your life such as a new baby, a home, a new job, adjust your portfolio to achieve new goals.

Rebalance

You should be happy as long as your investments are performing the average since that’s the point of passive investing. However, the weight of a financial asset is constantly changing since certain assets perform better than others. Rebalancing a portfolio means selling and buying stocks and bonds once in a while to maintain the original asset mix strategy.

If a portfolio has 50% stocks and 50% bonds, this ratio will change over time naturally since the the value of assets change differently. If a year later, the portfolio is 45% stocks and 55% bonds, some of the stock having lost its value, rebalancing means buying more stocks, or selling off the bonds to return back to the original 50/50 allocations.

Life Changes, So Does Your Portfolio

When a major life event happens, the time horizon is shorter, and the portfolio should be adjusted. Basically, you want to adjust how much risk you are taking by changing the asset mix.

When you are approaching retirement, you may consider changing your asset mix to be more conservative.

If your child is in high school, check to see if the RESP portfolio is taking on any unnecessary risk.

Time's up