As an international student in Canada, Erica pays about 40K for her tuition every year. She spends $1,200 for rent, and other expenses are about $2,000 a month, which her parents have been covering. Here Erica discusses how she deals with tax filing, and calculates tuition tax credit.

STEP 1: Fill Out Tax Return

How did you find a way to file taxes in your first year?

I learned about tax basics from my student union. Then I found a personal accountant to help me file my taxes every year. They don’t charge much to students. My rent, tuition, and texbooks are eligible for tax credits, and I’ve received about a thousand dollars back before. When I have a part time job, I also get more of a tax return.

When you receive money from your parents abroad, is it considered income?

I don’t think so. My accountant explained to me that it is a gift, so I don’t have to report this money.

What happens if you don’t file taxes?

Everyone recommends that I file my taxes every year so it is more organized. That way, all the papers needed to return tax for that year are easy to find. I thought it was a bit of a pain, but I would rather not miss out on $1,000. My accountant told me I could file every two years. I will still get the tax benefit. If I skip two years, I hear my returns are not guaranteed.

STEP 2: Calculate Maximum Tax Returns

How much could you get from tuition tax credits?

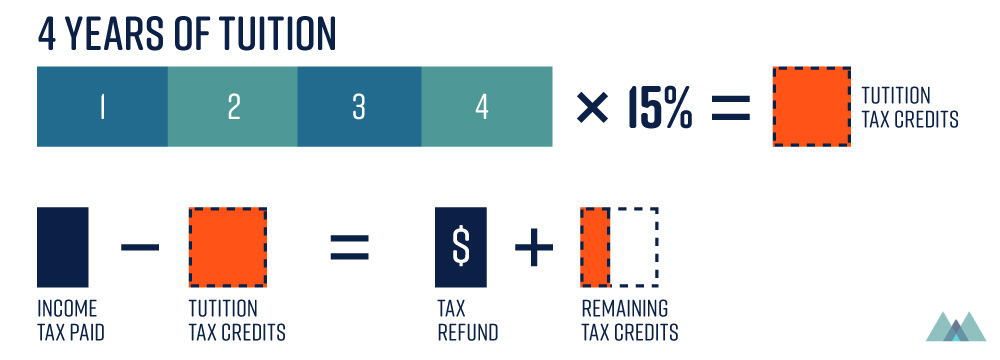

It’s 15% of what I pay for tuition now. The maximum tuition tax credit is based on the lowest personal income tax rate, which is 15% in 2016. In my case, it will be $40,000 x 15% = $6,000 per year. 4 years in total will be about $24,000. It’s a lot of money since international students pay more tuition than domestic students.

When will you receive that return?

I should have a taxable income in Canada first. It’s not like CRA will just send me money. Let’s say I get a job that pays me a 50K salary every year. My payroll will deduct income tax about $8,400 throughout the year. Because of my 24K tuition credits, CRA will send this $8,400 back. I will still have credit left, so I won’t be paying any income tax for 2~3 years.

In my case, I started working part-time since last year, so I will get some portion of the tax credit back when I file my tax this year.

STEP 3: Set a Plan

What if you move to another country after graduation?

Yeah. I may get a job in another country after graduation. You never know.

If I had a husband or partner or my parents with me, I could carry forward this year’s credit (maximum $5,000) against their income tax. I could also carry forward unused amounts to future years (no limit to carry-forward period). I will just need to make income in Canada to be able to get a tax refund at some point.

Have you had a thought about how you will use the money?

It’s a lump sum, so I can think of many things I might do. I was looking forward to planning a trip with my friends, but my parents told me I should look for investment options. I may divide it into a ratio of 40:60.

Do your friends know about tuition tax credits?

Some of them know. However, I hear the government may try to change education tax credits for the next school year. It seems like my credits will not disappear since I am graduating this year, however, I will keep my mind open to what’s happening to maximize on my tax return. Since I am considering graduate school in the future, Ontario’s new policies about free tuition sounds interesting. It sounds like it is solely for low-income families though.

One Comment

Comments are closed.