I thought I had common sense when it came to money management and personal finances. I lived by these common statements, “Be careful with debt” and “Live below one’s means”.

However, living in a city by myself, even with a decent salary, there was nothing motivating me to do something more with money. Even a small condo costs $600K in Toronto, so what’s the point of penny pinching a measly $300 every month?

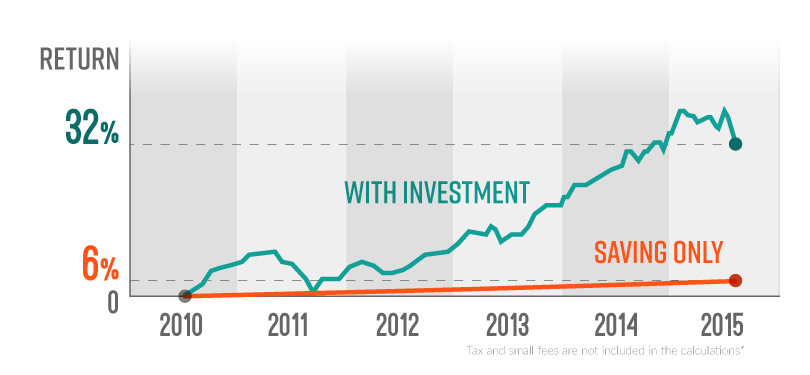

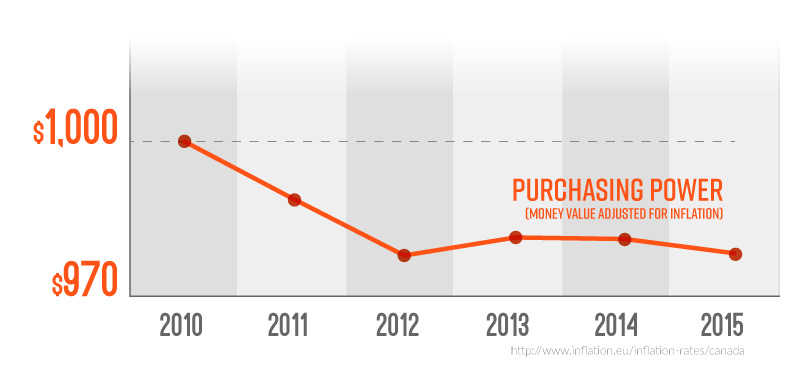

However, when I met my then-boyfriend, who openly talked about money, and shared his “portfolio” with me, I’d felt cheated. Over the last 5 years, his investment had made over a 30% return, while my savings had brought me an incomparable 5% return only. Not to mention, with inflation, these savings had literally been burned up.

ME: How did you even come up with this idea?

J: For retirement, obviously.

ME: But you’re only 27.

J: My parents told me I should start preparing for retirement as soon as I get my first job. What are your goals?

ME: Goals? What goals?…

I didn’t think I needed clear goals for managing my finances. I didn’t realize others were investing to grow their wealth long-term. No one told me about investment strategies and concepts. I was simply unaware of my potential as an investor.

Driven to do research to improve myself, I discovered that the basics of personal finances and investments aren’t that difficult to understand, but there are barriers for beginners: the jargon [1], complex numbers, and contradictory advice.

Understanding even a few of the concepts, such as compounding and risk, can change a passive saver into a beginner investor. As well, fast-changing investing platforms and services now offer more economical and sustainable tools for beginner investors.

My mission is delivering easy but meaningful financial learning tools so that others won’t miss out on time and opportunities like I had. After understanding the basics, it’s possible to choose the best financial path for ourselves. And trust me, no one cares about your money as much as you do.

Here are few articles about me.

[1] de Bassa Scheresberg, Carlo, Annamaria Lusardi, and Paul J. Yakoboski. “Working Women’s Financial Capability: An Analysis across Family Status and Career Stages.” TLAA-CREF Institute Report (2014).