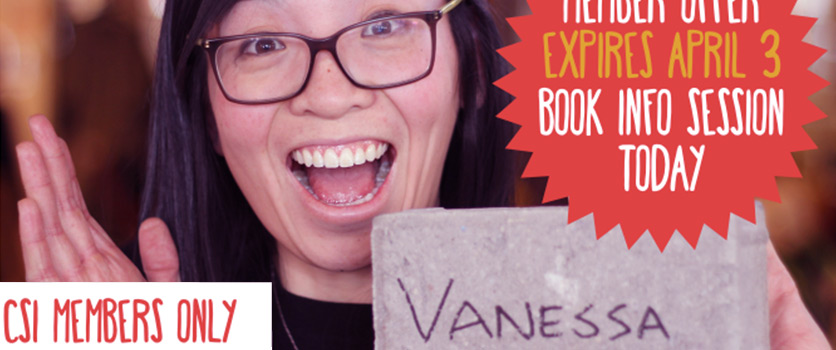

After years of experience as a project manager for a successful Toronto startup WatrHub, Vanessa Ho is currently located in the Netherlands. Now she works with Innovative Travel in Amsterdam and enjoys her bicycle adventures in Europe. Just entering her 30s, Vanessa shares her investing lessons and her experience with investment portfolios. More to come in part II.

Start Your Investment Portfolios Earlier

Julie: Looking back, would you do anything differently for your personal finances?

Vanessa: I wish I started learning about investing earlier. If I knew what $1,000 invested 10 years ago would be worth today, I would have been much more motivated put my money into investment vehicles, instead of just a savings account.

However, mindset is as important as knowledge. I’d known about investment options, but they seemed very unattainable, especially because all the savings from my first job went towards funding my master’s degree. I also cared so much for travel and clothes when I was 20. I am not sure knowledge only could have motivated me to take actions.

Julie: Lately, market shows low interest rates and returns. Do you still feel encouraged to save and invest?

Vanessa: That’s a tough one – right now the outlook for investing is pretty rocky, especially since the Canadian dollar took a dive last year. From the ‘buy low, sell high’ perspective, now is a great time to buy stocks that have taken a dive, but I can definitely understand the fear and hesitation to buy during a time of volatility.

Pinkfolio:

- If you have invested $1,000 in 2006 into US equity market, and followed market average, your money is now $2,002 (with 7.3% return) . This money can become $8,279 in 2036 with the same rate of return every year. Don’t forget the power of compounding.

- Our psychology biases sometimes delay investment decisions. Humans are risk averse and want to invest when the market is doing well. However, your return has a higher chance of growth when you buy during a market downturn.

Where You Can Learn Investment Basics

Julie: Where was your starting point for investing?

Vanessa: Reading about investments. I picked up my first investment book almost by accident at a book fair. I had been thinking about investments for a while but had never set aside time to think and learn more about it until then. Then I started subscribing to investment and finance-related newsletters. I follow a few blogs (Bridge Eastgard, Canadian Couch Potato) that are great because they are Canadian, so their advice is extremely relevant to me.

I also talk to people I trust: my dad and some friends, but I wish I had more friends with similar situation to talk about investment. I have very few female friends that I can talk to about investing. Others don’t invest, or let their banks take care of their money. On the other hand, some of my male friends work in the financial industry and so the scale and types of investment are quite different from mine.

Pinkfolio:

- Great authors to follow (Canadian):

Jonathan Chevreau, Ellen Roseman, Dianne Maley, Andrew Allentuck

Find Meaning in Investing

Julie: What are your key findings from conversations about investment?

Vanessa: Last year, my friend Tim Nash (Sustainable economist) looked at my investment portfolios and told me that a healthy investment portfolio should include both Canadian stocks and bonds.

Around the same time, I began hearing about a community bond that was being offered by the Centre of Social Innovation (CSI), where my previous company was located. CSI were expanding their facilities and issuing a bond to raise the funds to purchase a new building downtown Toronto. To me, it seemed like a very reasonable investment for a cause that really resonated with me. This is an investment that I really care about because I know the people at CSI very well and I know how much of an impact I can have as an investor with them.

What I discovered in the end was I want to invest in something I believe in. My passion is environmental and social impact. I’d like to know what I am investing into and want to be proud of what I am contributing to.

Pinkfolio:

- Benefits of including domestic stocks and bonds in your investment portfolios: Unlike foreign funds, your domestic stocks and bonds can offer tax advantages on capital gains and dividends, and there is no risk for exchange losses and conversion fluctuations.

- Community bond: are interest-bearing bonds intended for small scale, non-accredited investors and can only be issued by a non-profit organization. For more information: Read this article.

- Impact investing: “made into companies, organizations, and funds with the intention to generate a measurable, beneficial social or environmental impact alongside a financial return” Reference

Another reason to include domestic stocks and bonds in your portfolio is because people understand their home country’s politics better. That way investors make better judgement about investing in their home country.