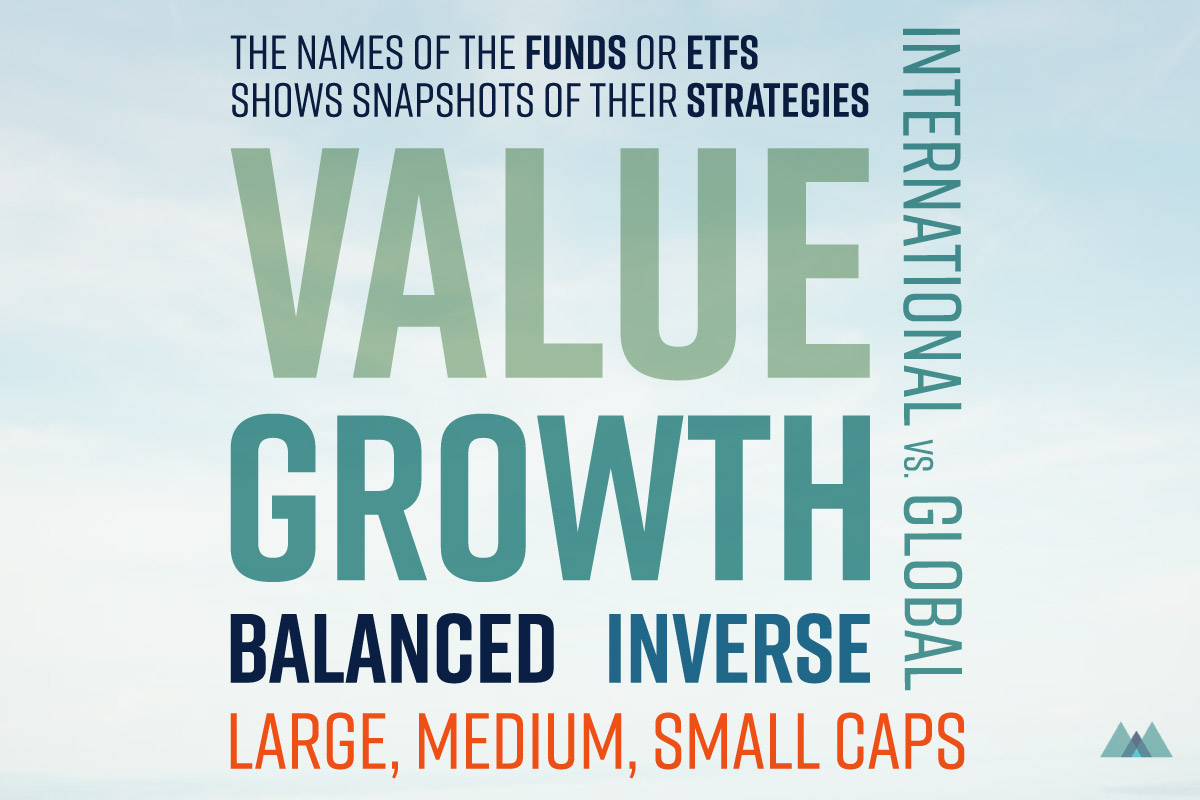

The names of the funds or ETFs show a snapshot of their strategy. Remembering just several terms can help you to narrow down what you want quickly.

Fund Families & Fund Providers

There are lots of fund management companies that sell funds. The fund provider is the owner of the funds like the company, BlackRock. The provider owns a fund family, which is a brand like iShares. The 3 Largest Fund Providers in US:

- BlackRock owns iShares

- Vanguard Group owns Vanguard

- State Street Global Advisors owns S&P 500 SPDR (the world’s first ETF)

Well-Known Indexes

- S&P 500: 500 large size stocks representing the leading industries in the US economy. This is usually used as a benchmark for the US stock market as a whole.

- Nasdaq: 3000 largest stocks listed on Nasdaq which mainly consist of technology firms like Apple, Google and Microsoft. The Nasdaq is often used as a benchmark for the US technology sector.

- Dow 30: 30 significant stocks traded on the New York Stock Exchange. These are usually blue chip stocks like Coca-Cola and Nike. People watch this index because if the large, safe, US firms don’t do well, it is likely the entire market is not doing well.

- S&P/TSX: Canadian equivalent of the S&P 500 - the main industries are financials, energy, and materials.

- Russell 2000: Index made of the 2000 smallest firms in the US. This index is usually used if you want to look at how small size firms perform.

Large, Medium, Small, Micro Cap

- Firms are separated by size into Micro, Small, Medium, and Large based on a calculation called market capitalization (the price of a firm’s stock multiplied by the total number of shares the company has outstanding)

- Funds that specify the size will only invest in companies that are the correct size

Types of Funds or ETFs

- Value funds & ETFs include "Value" firms, which are considered to be underpriced right now, expecting these companies will eventually return to their “True” prices (Warren Buffett famously targets Value companies)

- Growth funds & ETFs pick up companies showing characteristics of growing very rapidly to yield future profit (e.g. Tesla). Growth companies are the opposite of Value companies.

- Balanced funds are used to describe funds that holds a combination of assets, and try to keep the balance between the two asset classes stable (e.g. 60% Stocks 40% Bonds)

- International Vs. Global

- International funds are funds that will only invest in securities other than your own country

- Global funds describe funds that will look for good investments from any country in the world including your own country - Income funds have the goal of generating income for its investors. Unlike a dividend fund, which only invests in dividend paying stocks, income funds will also invest in bonds and money market instruments.

- Inverse funds will move in the opposite direction of the index it tracks. They are used to profit if you believe the markets will fall. If the S&P 500 moves down by 5%, an inverse fund tracking the S&P 500 will move up by 5%.

- Leveraged funds borrow money in order to amplify returns. These funds are riskier than normal funds and are not recommended to hold for the long term.

Time's up