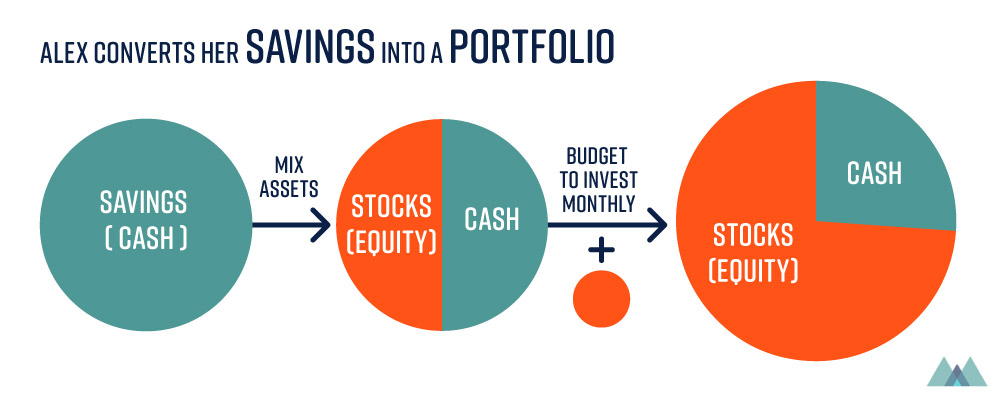

Alex is 27 years old and works as a freelancer. She just started learning about the importance of investing for the future, and began her investment journey with index mutual funds. Alex has $8,000 in her savings account, and puts $400 aside every month.

Step 1: Money Talks

Q: What made you start investing now?

I make a decent income as a freelancer, but I don’t get pension plans or stock options like my friends working for government or corporations. I have no other choice but becoming more initiative about investment.

On the other hand, if I put half of my saving ($4K) first, and invest $400 every month with 6% of yearly return, I can come up with $72K in 10 years according to this calculator.

Q: Why did you choose to invest in index mutual funds out of all the options?

Mutual funds seemed to be the easiest option for beginners with not a lot of money. You can automatically deposit small amounts every month which makes it easy.

An experienced friend of mine noted 2 pieces of advice when it came to mutual funds. She recommended passively managed funds - index mutual funds. At first, I thought the word “passive” sounded kind of bad, but I later learned that these funds basically follow the market average (index) and charge less management fees (MER). She also told me to choose a fund without sales charges (Loads), as they become transaction fees (i.e. every time you buy or sell).

I also went to my bank and had a conversation with one of the advisors. We discussed my income, risk tolerance, and duration for investments. They suggested one of the bank’s mutual funds but instead of taking it right away, I decided to do some research myself and think it over.

Step 2: Compare Options

Bank websites publish all their funds’ reports. I just needed to make sure I was looking at the right one since many funds sound similar. The best way is to check is the fund code. The fund my bank advisor recommended seemed to be okay, but I was wondering about other index mutual funds a friend had recommended.

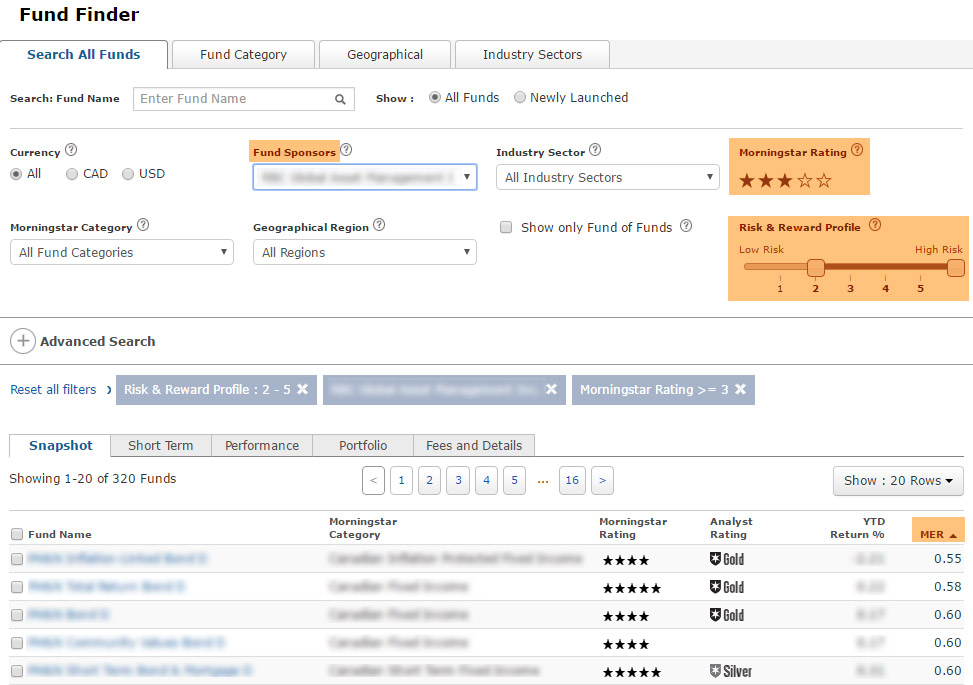

My boyfriend showed me Morningstar’s Fund Finder. We wanted to compare mutual index fund options by MER. Here’s my process.

- Set Morningstar Rating 3 or higher

- Set Risk 2-4

- Align all funds by MER

- Choose my bank as Fund Sponsor

When I aligned the funds by MER, the lowest MER ones were usually index mutual funds.

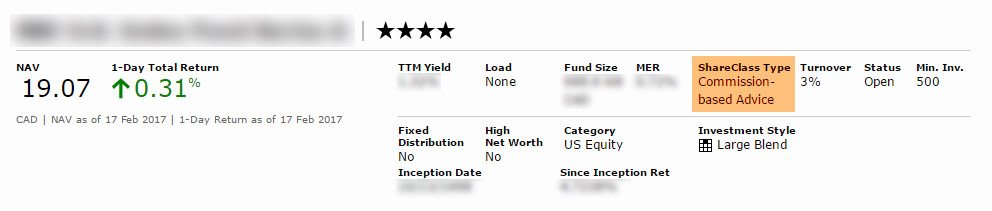

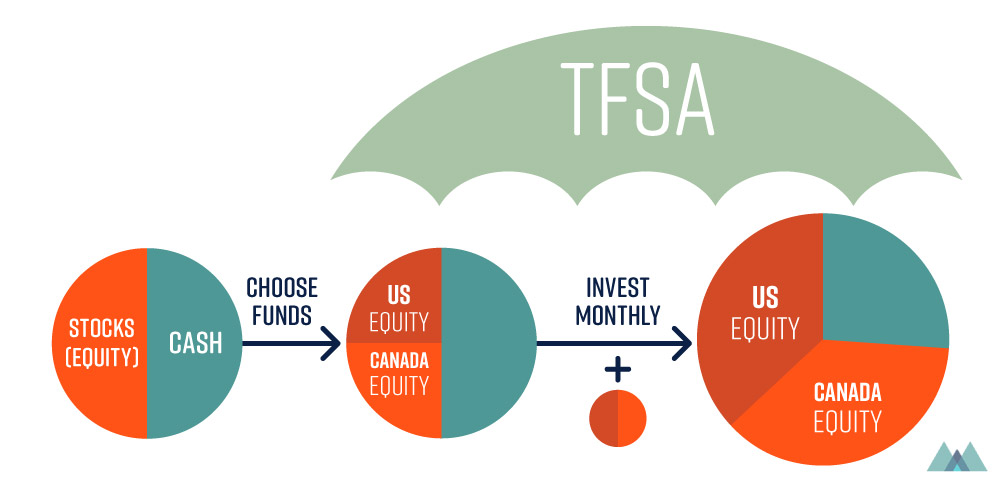

When I click the fund, more data shows up. Their ratings were great. Since I wanted to get it done at the branch, I chose “Commission-based Advice” funds instead of “Do-It-Yourself”. At this point, I just want to invest in North American stocks, so I chose US Equity and Canadian Equity funds.

Step 3: Make the transaction

Q: So the bank person was okay you changed your mind?

Actually, I had to see 2 more people to be convinced of my own choice of funds. Some bank advisors didn’t want to do it for me since they disagreed with my choice. I contacted more people and humbly explained that this is what I really want.

Q: How long did the whole process take? Did you have to make any major decisions?

I got everything done in the branch in an hour. The only major decisions I made was how much I wanted to invest, and which tax shelter to go with. I used half of my $8K saving as initial investment (the rest is my emergency savings), then set up automatic contribution of $400 every month. Experts call this “Dollar Cost Averaging”. I am keeping everything at 50:50 as far as US and Canada equity funds for now.

Q: Do you have a TFSA or RRSP account to avoid paying tax on returns?

Yes. Since my current income isn’t too high, my focus is TFSA. I like the flexibility of TFSA since I don’t need to pay fees when I withdraw money. Once I top up my TFSA, I will start putting my investments in RRSPs.

What’s Your Next Step?

Now that I’ve started investing, I’m really glad I did. I feel kind of proud of myself. I hear there are more ways of investing, but I have to start from somewhere right now. Otherwise, I could end up putting it off forever.

Since it doesn’t take too long, if I want to sell my fund shares, I will do further research and add more assets as my portfolio grows.