Time Horizon Is like a Deadline

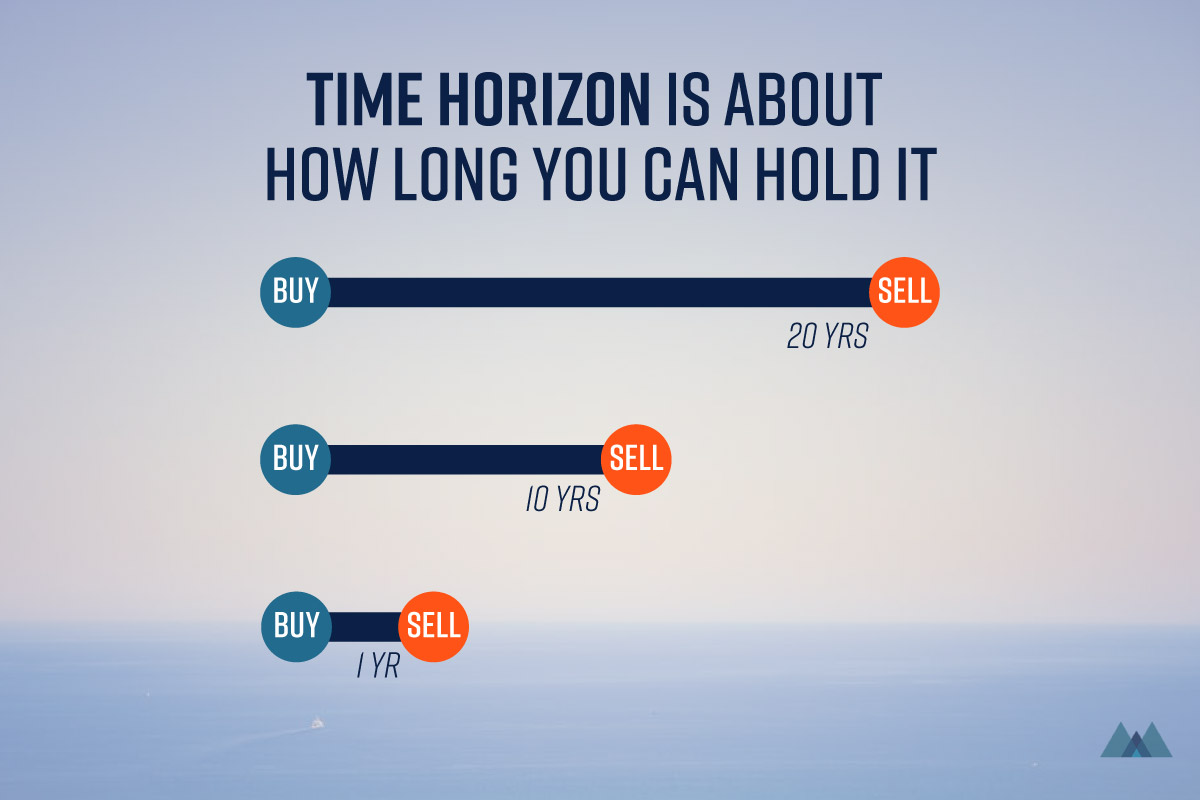

Time horizon is the duration of time your investment is kept before it is sold. For active stock traders time horizons can be just seconds. For those who are building up a retirement savings, their time horizon can be decades.

There is no “right” time frame - it depends on the investor’s individual needs and the existing market situations. It’s something to consider since the time you have will affect your strategy.

Margaret has $30,000 in cash to pay her graduate school in a year’s time. Since the time horizon is short, Margaret should invest her money in low-risk assets to protect the principal.

Andy, 25, just started investing for her retirement. She chose an aggressive portfolio with 80% dedicated to various stocks since she has 40 years to go. As she approaches her 30s and 40s, she will reduce the portion of stocks and take safer and more short-term investments.

Major factors that can affect your time horizon are age, health, employment status, and major life events. If you are in your 20s and you don’t have any big financial burdens, then your investment time horizon is long. Someone working under a short-term contract may not want to dedicate all investments for a long time horizon because he or she might need money that is easily accessible.

Time's up