(Following the first story) Pam started her own app development business 9 months ago in Ontario, Canada, and she’s already seeing some success. After taking small projects for 6 months, she signed a contract that would steady her small business. Now that her projected revenue exceeds 30K, she’s required to register her business and find better ways to organize her growing finances.

Step 1: Register a Small Business

Was it time-consuming to register your business?

Getting it done was simple, but I had to understand some of the basics. Basically the government wants businesses to pay taxes, so they want us to register. I had to do 2 things - register my business name from ServiceOntario, and get a business number from CRA.

Before choosing a business name I had to do some research. If someone has already taken the name, it isn’t available. What I did was I brainstormed a list of names, and googled them to check if the domain was taken (If the domain was taken, the name was likely to be taken). Then I searched the likely to be available names through the ServiceOntario website, and registered my first-choice “PamMakesApps”.

Next I had to decide what type of business it was going to be. I decided to go for the simplest form, sole proprietorship, since it’s a one-person business making under 100K. Sole proprietorship means I am the sole owner of the company. I can always convert my business to become a partnership or corporation, as my business evolves.

After that, it’s just filling out information like addresses and emails online, and paying some fees. After I registered my business name, I registered my business at CRA’s website to get a business number (BN). A BN is basically an ID number for a business.

Step 2: Apply HST to Invoices

What was the process after registering?

I received letters from ServiceOntario and CRA, which I kept organized in one folder. I paid particular attention to the harmonized sales tax, HST. When CRA assigns you a BN, a HST number comes with it. Once my business was registered, I had to include my HST information in my invoices to clients.

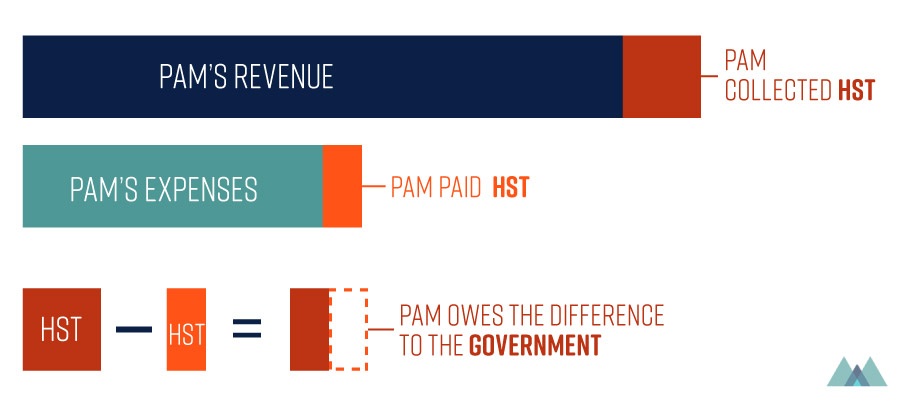

Here’s the simplistic way I get this HST system. Say my client collects $100K as HST through their own product sales, and I, PamMakesApps, charge them $5K HST. They simply owe the government the difference, or $95K.

In reverse, let’s say I receive $5K HST from a client, and paid $500 HST for buying equipment. I now owe the government $4,500.

Obviously I don’t charge HST when I invoice my international clients. But tax is always something to clarify when the invoiced amount is not trivial to clients. Accountants know a lot more details, so you should discuss further.

Step 3: Open a Business Account & Get a Business Credit Card

What was the process of opening a business account?

I informed the bank about my obtained business number, and set up a proper business account in order to separate my business transactions from personal ones.

Because business accounts charge monthly fees, I waited until PamMakesApps started receiving revenue to open an account. I took my first cheque and opened an e-account (that has lower fees), since I don’t have many transactions going on right now and I find online banking easy to handle. Once my business requires more transactions and services, I will upgrade my account.

I also applied for a business credit card and overdraft protection. I’m usually cautious with credit cards, but I said yes this time. It makes my life easier since I can exclusively use the card for business expenses.

Overdraft protection is beneficial since unexpected expenses can happen. I picked a plan that doesn’t charge any fees unless overdraft actually occurs. I heard it’s kind of pain to wait and apply for it again, so I did it altogether.

What’s Your Next Step?

Right now I’ve just been inputting numbers on a spreadsheet, so I’m trying to look into better ways to organize my finances. I should also chat with an accountant about potential clients in other countries.