Sam (24) was okay living paycheck to paycheck until her friends invited her for an adventure trip next year. She sees about $1500 left every month after paying rent, utilities, bills, and transportation. It shouldn’t be impossible to grow her travel fund if she cut down spending on small things. It feels like pennypinching, but better than growing her debt and spending all money on interest payments.

STEP 1: Make Lattes at Home

How did you find ways to cut down the cost?

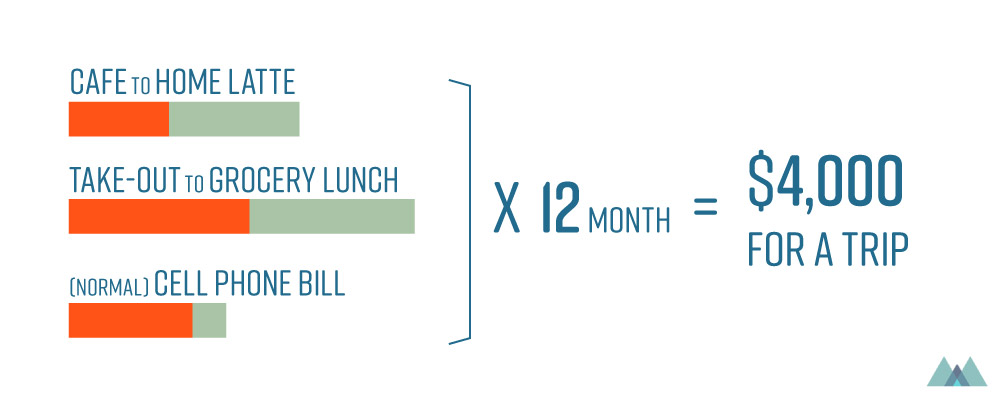

I need $4000 for the next 12 month, and need to save more than $300 for that. With this Calculator showing common places to cut down cost, I decided to spend less to buy breakfast and lunch.

I easily spent $20 on a coffee & muffin as well as take-out lunch every day. It’s almost $500 per month. If I prepare breakfast and lunch at home, the cost would be around $200. Obviously, I’m aware my solution isn’t to cook everyday.

Breakfast

I love coffee and I don't want to switch to instant coffee right now. But a latte from a cafe is almost $5. My solution is to use a stovetop espresso machine (I found one for $35). This is what Italians use at home instead of an expensive espresso machine. With microwaved milk, I can make a decent latte for less than $1. I also buy pastries in bulk for breakfast and freeze them.

- One time cost - Moka pot: $35

- Monthly cost - Ground coffee + milk + bakes + fruits: $70

Lunch

Again, I am not going to cook everyday. I buy salads, bread, and soup every monday and keep them in the fridge at work. When I cook, I try to cook a large amount and separate them into lunch-size portions.

- One time cost - sealable plastic bags + containers: $20

- Monthly cost - groceries for lunch: $130

Isn’t it kind of sad to stop going out though?

I thought I would feel so lame, but it was not as terrible as I thought. I have a goal so I’m just prioritizing my resources differently. And, of course, I still indulge in social breakfasts or co-worker birthday lunches once in awhile. I didn’t stop going out with my friends on the weekend. I consider any spending I do on my social life as rewards for myself.

STEP 2: Create a Forced Saving System

How do you check your travel fund is growing?

I automatically send $300 somewhere I can’t touch, at least for next 12 months. It can be all done at the bank. Ideally, I want to make a bit of interest, but interest rates are super low right now.

I had to debate between short-term investment options and saving options.

- GIC - won’t work since I should have a chunk of money saved first.

- Money Market Funds - when interest rates are low, annual returns on money market funds are very low (less than 1%).

- High interest saving account - deposit interest rates are very low, but it’s possible to find promotional rates from banks or higher interest rates from credit unions.

I also put my savings under TFSA because the interest I earned won’t be taxed. I learned that I can freely withdraw and deposit funds to TFSA of up to $5,500, so why not?

STEP 3: Calculate and Adjust the Saving Plan

So you can see you are exactly on track?

Even with a bit of interest, I’m still $360 short of my target of $4,000 according to the savings calculator. By increasing my monthly savings by $30, I can reach my goal.

Where did you find more way to save?

Usually I am too lazy to try this, but I carefully looked at my cell phone bill ($95 / month) and decided to switch to a cheaper plan ($65). I rarely use all the services included in my plan. I mostly uses text and my home and work has wifi. I just envisioned my trip and forced myself to call up the telecommunications company. In the end, I regretted not doing this earlier. Why was I paying so much for years? With this extra $30, I am right on track to go on my trip next year.

My friend also told me buying basic cosmetics, hair products, kitchen and bathroom items online is much cheaper. Walmart and Amazon sells most of the stuff I need much cheaper than retail shops. They also deliver all of the items to my place. I feel like I’m finding more and more ways to cut down on small costs. I could easily increase my monthly savings to $350.